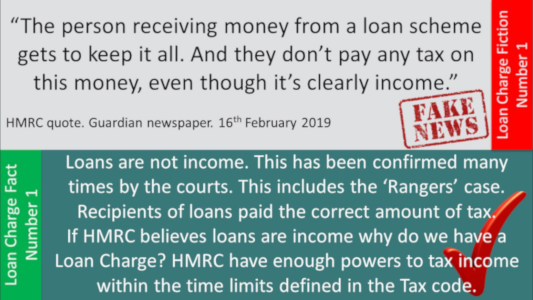

Aussies against unlawful foreign tax claims

Retrospective tax is unacceptable — all Australians deserve certainty in their affairs.

Foreign claims should only be considered in cases of criminality, and certainly not in contrived attempts to bolster a foreign agency's funds due to decades of incompetence, neglect and inaction.

We are a support group for Australians who are now at the mercy of the Australian Tax Office for unlawful foreign tax claims from other countries.

The focus of our group was initially to fight the retrospective UK Loan Charge, but we now see unlawful foreign tax claims from outside the UK too.

If you:

- worked as a contractor or freelancer in the UK and were paid using a loan arrangement

- worked outside of Australia, but now find yourself with an invalid or unlawful foreign tax claim on the ATOs foreign claims register